What Is The Top End Income That Registers At The Poverty Level

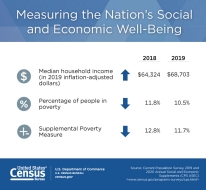

SEPT. xv, 2020 — The U.S. Census Agency announced today that median household income in 2019 increased 6.viii% from 2018, and the official poverty rate decreased 1.3 percentage points. Meanwhile the percentage of people with health insurance coverage for all or part of 2019 was 92.0% and 8.0% of people, or 26.1 million, did not take wellness insurance at any point during 2019, according to the 2020 Current Population Survey Annual Social and Economical Supplement (CPS ASEC).

Median household income was $68,703 in 2019, an increase of 6.8% from the 2018 median. Between 2018 and 2019, the real median earnings of all workers increased by 1.4%, while the existent median earnings of full-time, yr-round workers increased 0.8%. The 2019 real median earnings of men and women who worked full-time, year-circular increased by 2.1% and 3.0%, respectively, between 2018 and 2019. The departure between the 2018-2019 percent changes in median earnings for men and women working full-fourth dimension, year-round was not statistically pregnant. The number of full-time, twelvemonth-round workers increased by approximately i.2 million betwixt 2018 and 2019. Betwixt 2018 and 2019, the total number of people with earnings increased past about 2.2 1000000.

The official poverty rate in 2019 was 10.5%, a subtract of 1.iii percentage points from 11.8% in 2018. This is the fifth consecutive annual decline in the national poverty charge per unit. Since 2014, the poverty rate has fallen four.3 percent points, from 14.viii% to 10.5%. The 2019 poverty rate of ten.5% is the lowest rate observed since estimates were initially published for 1959. The number of people in poverty in 2019 was 34.0 million, four.2 1000000 fewer people than 2018.

Private wellness insurance coverage was more prevalent than public coverage, roofing 68.0% and 34.1% of the population at some point during the twelvemonth, respectively. Employment-based insurance was the most mutual subtype. Some people may take more than than i coverage type during the agenda year.

These findings are contained in 2 reports: Income and Poverty in the United States: 2019 and Wellness Insurance Coverage in the U.s.: 2019.

Some other Census Bureau report, The Supplemental Poverty Measure: 2019, was also released today. The Supplemental Poverty Measure out (SPM) charge per unit in 2019 was 11.seven%. This was ane.0 percentage bespeak lower than the 2018 SPM rate of 12.8%. The SPM provides an culling mode of measuring poverty in the Usa and serves equally an boosted indicator of economic well-being. The Census Bureau has published poverty estimates using the SPM annually since 2011 with the collaboration of the U.S. Agency of Labor Statistics (BLS).

The Current Population Survey (CPS), sponsored jointly past the Demography Bureau and BLS, is conducted every month and is the chief source of labor strength statistics for the U.Southward. population; it is used to calculate monthly unemployment rate estimates. Supplements are added in most months; the CPS ASEC is designed to give annual, national estimates of income, poverty and health insurance numbers and rates. The CPS ASEC is conducted in February, March and April. It collects data about income and wellness insurance coverage during the prior calendar twelvemonth. Every bit data were collected in February, March and April 2020 about income and health insurance coverage in 2019, this written report does not reverberate economical impacts related to COVID-19, but instead serves equally a pre-pandemic criterion for time to come research.

This year, data collection faced extraordinary circumstances. As the United states began to grapple with the implications of the COVID-19 pandemic for the nation, interviewing for the March CPS began on March 15. In order to protect the health and safety of Demography Bureau staff and respondents, the survey suspended in-person interviewing and closed both Calculator-Assisted Phone Interviewing (CATI) contact centers on March twenty. For the residuum of March and through Apr, the Demography Bureau connected to attempt all interviews by phone. For those whose first month in the survey was March or April, the Census Bureau used vendor-provided telephone numbers associated with the sample accost.

While the Census Bureau went to great lengths to consummate interviews past telephone, the response charge per unit for the CPS basic household survey was 73% in March 2020, about ten percentage points lower than in preceding months and the same menses in 2019, which were regularly above eighty%. The alter from conducting first interviews in person to making offset contacts by phone contributed to the lower response rates and it is likely that the characteristics of people for whom a phone number was found may be systematically unlike from the people for whom the Demography Bureau was unable to obtain a phone number. While the Census Bureau creates weights designed to arrange for nonresponse and to control weighted counts to independent population estimates by age, sex, race and Hispanic origin, the magnitude of the increase in (and differential nature of) nonresponse related to the pandemic likely reduced their efficacy. Using authoritative data, Census Agency researchers have documented that the nonrespondents in 2020 are less like to respondents than in earlier years. Of particular interest for the estimates in this study released today are the differences in median income and educational attainment, indicating that respondents in 2020 had relatively college income and were more educated than nonrespondents.

The 2019 income and poverty report is based on the CPS ASEC and includes comparisons with the previous year and historical tables in the report, which incorporate statistics dorsum to 1959. The health insurance study is based on both the CPS ASEC and the American Community Survey (ACS). Country and local income, poverty and health insurance estimates from the ACS will exist released Thursday, Sept. 17.

Income

Median household income was $68,703 in 2019, an increment of 6.viii% from the 2018 median of $64,324.

The 2019 real median income of family households and nonfamily households increased 7.3% and vi.2%, respectively, between 2018 and 2019. This is the fifth sequent annual increment in median household income for family households and the 2d consecutive increment for nonfamily households. The difference between the 2018-2019 percent changes in median income for family unit (vii.iii%) and nonfamily (half-dozen.2%) households was not statistically significant.

Real median household incomes increased for all regions in 2019: 6.8% in the Northeast, 4.8% in the Midwest, 6.i% in the South, and 7.0% in the West. The differences between the 2018-2019 percent changes in median household income for all regions were non statistically significant.

Race and Hispanic Origin

(Race information refer to people reporting a single race only; Hispanics can be of whatever race.)

- The 2019 real median incomes of White, Black, Asian and Hispanic households all increased from 2018. The differences between the 2018-2019 percent changes in household median income for each race group were not statistically pregnant.

Earnings

- The 2019 existent median earnings of men ($57,456) and women ($47,299) who worked total-time, yr-round increased by 2.one% and 3.0%, respectively. The difference betwixt the 2018-2019 percent modify in median earnings for men working full-time, year-round and women working full-fourth dimension, year-round was not statistically significant.

- The 2019 female-to-male person earnings ratio was 0.823, not statistically dissimilar from the 2018 ratio.

- Betwixt 2018 and 2019, the real median earnings of all workers and full-fourth dimension, twelvemonth-round workers increased 1.iv% and 0.8%, respectively.

- Between 2018 and 2019, the total number of people with earnings, regardless of work experience, increased by about 2.ii one thousand thousand. The number of total-fourth dimension, year-round workers increased past approximately i.ii million.

Poverty

As defined past the Part of Management and Budget (OMB) and updated for inflation using the Consumer Price Index, the weighted average poverty threshold for a family unit of four in 2019 was $26,172. (See <www.demography.gov/data/tables/time-series/demo/income-poverty/historical-poverty-thresholds.html> for the consummate set of dollar value thresholds that vary past family size and composition.)

- The official poverty rate in 2019 was 10.v%; downwardly 1.3 per centum points from 11.eight% in 2018 (the OMB determined the official definition of poverty in Statistical Policy Directive 14).

- The 2019 poverty rate of 10.v% marks the 5th consecutive annual decline in poverty. Since 2014, the poverty charge per unit has fallen iv.three percentage points, from 14.8% to 10.5%.

- The 2019 poverty rate of 10.5% is the lowest rate observed since estimates were initially published for 1959.

- In 2019, there were 34.0 million people in poverty, approximately 4.2 meg fewer people than 2018.

Race and Hispanic Origin

(Race data refer to people reporting a single race only; Hispanics can be of whatsoever race.)

- Between 2018 and 2019, poverty rates declined for all major race and Hispanic origin groups.

- The poverty rate for Whites decreased 1.0 percentage indicate to 9.1%. The poverty rate for Blacks decreased by ii.0 per centum points to 18.eight%. The poverty rate for Asians decreased 2.viii percentage points to seven.3%. The poverty charge per unit for Hispanics decreased by 1.eight percentage points to 15.seven%.

- The percent point change in poverty rates from 2018 to 2019 for Blacks is not significantly dissimilar than the percentage point change for Whites, Asians or Hispanics. The percentage indicate modify from 2018 to 2019 for Hispanics is not significantly unlike from the percentage signal change for Asians.

Age

- Betwixt 2018 and 2019, poverty rates for children under the age of eighteen decreased ane.eight percent points, from 16.2% to 14.4%.

- Poverty rates decreased ane.two percentage points for adults ages 18 to 64, from 10.seven% to 9.4%.

- The poverty rate for people age 65 and older decreased by 0.9 percentage points, from 9.7% to 8.9%.

Supplemental Poverty Mensurate

The SPM extends the official poverty measure by taking into account many of the authorities programs designed to aid low-income families and individuals that are not included in the electric current official poverty measure.

- The SPM released today shows: in 2019, the overall SPM rate was eleven.seven%. This was 1.0 percentage betoken lower than the 2018 SPM rate of 12.eight%.

- The SPM charge per unit for 2019 was i.iii percentage points higher than the official poverty rate of 10.5%.

- There were 16 states plus the District of Columbia for which SPM rates were higher than official poverty rates, 25 states with lower rates, and 9 states for which the differences were not statistically pregnant.

- Social Security continued to be the most of import anti-poverty program, moving 26.5 1000000 individuals out of poverty in 2019. Refundable tax credits moved vii.five meg people out of poverty.

Age

- SPM rates were downward for all major age categories: children under age 18, adults ages 18 to 64, and adults historic period 65 and older between 2018 and 2019.

While the official poverty measure includes only pretax coin income, the SPM adds the value of in-kind benefits, such as the Supplemental Diet Assistance Program, schoolhouse lunches, housing assistance and refundable taxation credits.

Additionally, the SPM deducts necessary expenses for critical goods and services from income. Expenses that are deducted include taxes, kid care, commuting expenses, contributions toward the cost of medical care and health insurance premiums, and child back up paid to another household. The SPM permits the exam of the effects of authorities transfers on poverty estimates. For example, non including refundable revenue enhancement credits (the Earned Income Revenue enhancement Credit and the refundable portion of the kid tax credit) in resources, the poverty charge per unit for all people would take been 14.0% rather than 11.seven%. The SPM does not supercede the official poverty mensurate and is not used to determine eligibility for regime programs.

Health Insurance

Equally in the past several years, the Census Bureau is releasing estimates of health insurance from two surveys. The Current Population Survey Almanac Social and Economic Supplement (CPS ASEC) asks people about coverage during the entire previous calendar twelvemonth. The American Community Survey (ACS) asks people to report their health insurance coverage at the time of interview. The apply of both surveys provides a more complete picture of health insurance coverage in the United States in 2019. Highlights reporting coverage in 2019 come up from the CPS ASEC. Highlights reporting change in wellness coverage from 2018 to 2019 or wellness coverage at the state-level come from the ACS.

- In 2019, 8.0% of people, or 26.1 million, did non have health insurance at whatsoever point during the yr, according to the CPS ASEC.

- The percentage of people with health insurance coverage for all or part of 2019 was 92.0%.

- In 2019, 9.2% of people, or 29.vi million, were not covered by health insurance at the time of interview, according to the ACS, up from 8.9% and 28.6 million in 2018.

- In 2019, the percent of people with employer-provided coverage at the time of interview was slightly higher than in 2018, from 55.2% in 2018 to 55.4% in 2019.

- The per centum of people with Medicaid coverage at the fourth dimension of interview decreased to xix.8% in 2019, down from twenty.5% in 2018.

- Between 2018 and 2019, the percentage of people without health insurance coverage decreased in i land and increased in xix states.

- All states and the District of Columbia had a lower uninsured rate in 2019 than in 2010.

Regional trends are available for income, poverty, SPM and health insurance in each corresponding report, as well as tables showing state-level coverage for health insurance and poverty rates using the supplemental poverty measure.

State and Local Estimates From the American Community Survey

Some state-level health insurance data from the ACS are included in this release. On Thursday, Sept. 17, the Demography Bureau volition release 2019 unmarried-year estimates of median household income, poverty and health insurance for all states, counties, places and other geographic units with populations of 65,000 or more than from the ACS. These statistics will include numerous social, economical and housing characteristics, such every bit language, education, commuting, employment, mortgage status and rent. Subscribers will be able to access these estimates on an embargoed ground.

The ACS provides a wide range of of import statistics nearly people and housing for every customs (i.e., census tracts or neighborhoods) across the nation. The results are used by everyone from town and city planners to retailers and homebuilders. The survey is the only source of local estimates for nearly of the 40 topics information technology covers.

The CPS ASEC and ACS are subject to sampling and nonsampling errors. All comparisons made here and in each respective report have been tested and found to be statistically significant at the 90% confidence level, unless otherwise noted.

For additional information on the source of the data and accurateness of the income, poverty and wellness insurance estimates, visit <https://www2.census.gov/programs-surveys/cps/techdocs/cpsmar20.pdf>

###

What Is The Top End Income That Registers At The Poverty Level,

Source: https://www.census.gov/newsroom/press-releases/2020/income-poverty.html

Posted by: warrentrusen.blogspot.com

0 Response to "What Is The Top End Income That Registers At The Poverty Level"

Post a Comment